April 24, 2019

Year after year, farmers across Ontario choose to make Production Insurance part of their risk management plans. That's because Production Insurance offers predictable and stable coverage that farmers can count on.

Yield-based coverage that's predictable

With Production Insurance, each producer is guaranteed up to 90 per cent of their individual average farm yield. Because of this guarantee, producers are able to predict whether they may receive a payment.

When a customer's final yield falls below their guarantee because of an insured peril, they can count on Production Insurance to compensate them for the shortfall. Customers also know exactly what risks their crops are covered against – perils like adverse weather, disease, wildlife damage and insect infestation are covered under Production Insurance.

In the event that yields are higher than average, it will lead to higher Production Insurance coverage in future years, when customers need it. When this happens, a customer's average farm yield will increase, providing them with more coverage. To learn more about average farm yield and the features that keep it stable, see the

Yield Buffering feature sheet.

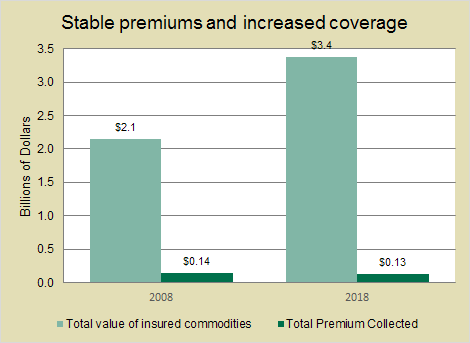

Stable premiums and increased coverage

In addition to the predictability of Production Insurance, the program is also designed to be stable and sustainable, with affordable premium rates. Even though crops are yielding much higher than in previous decades, premium rates have remained stable, and in recent years premiums overall have gone down.

Over the past 10 years, while claims have been consistent, the value of insured acres has increased by more than 50 per cent, mainly due to strong market prices. The overall decrease in premium rates has continued despite substantial increases in the value of the commodities insured under Production Insurance, making the program an even more affordable risk management option. When comparing the value of the commodities Agricorp insures to premium rates, Production Insurance provides more value than it did a decade ago.

Planning for the 2019 growing season

Production Insurance renewal packages have been mailed to customers. As customers review their risk management plans, they can consider the risks their farm may face in the coming growing season and update their Production Insurance coverage accordingly. Customers who would like to update their coverage and those who would like to enrol in Production Insurance can contact Agricorp by May 1.

In 2008, Agricorp insured $2.1 billion in commodities and collected $0.14 billion in premium. In 2018, Agricorp insured $3.4 billion in commodities and collected $0.13 billion in premium.