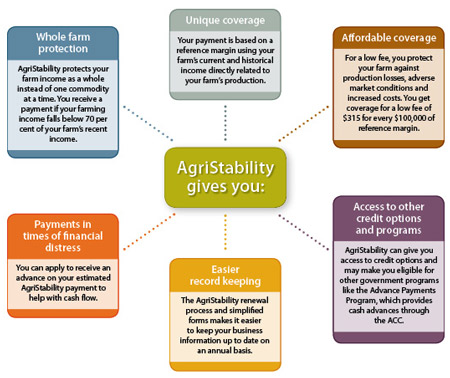

AgriStability is an important part of a comprehensive suite of risk management programs. AgriStability protects producers from large declines in their farming income caused by production loss, increased costs or market conditions.

Your allowable income and expenses for all the commodities you produce are used to calculate your margins, protecting the income of your whole farm.

Reminders

Compensation rate increased – Increased AgriStability compensation: more support for the same affordable fee

The compensation rate for AgriStability has been increased from 70% to 80%, starting with the 2023 program year. This is an increase Ontario supports, having provided the provincial portion since 2020. To learn more, read

More support for the same affordable fee.

AgriStability interim payments

An AgriStability interim payment could provide cash flow now – when producers need it most. Customers whose income has declined substantially and have completed six months of their fiscal year can submit an

interim payment application. Interim payments are 50 per cent of a producer's estimated final payment.

Your AgriStability Protection

Why include AgriStability in your business risk management plans?

Funding partners

Funding partners

AgriStability is part of the suite of programs established under the

Sustainable Canadian Agricultural Partnership agreement on agricultural policy. The costs of AgriStability are shared by the federal and provincial governments on a 60:40 basis. In Ontario, AgriStability is delivered by Agricorp.